Conversational AI for Banking and Financial Services

Provide 24/7 available banking customer support while reducing ops cost with Generative AI powering conversational banking.

Fostering success for 500+ customers

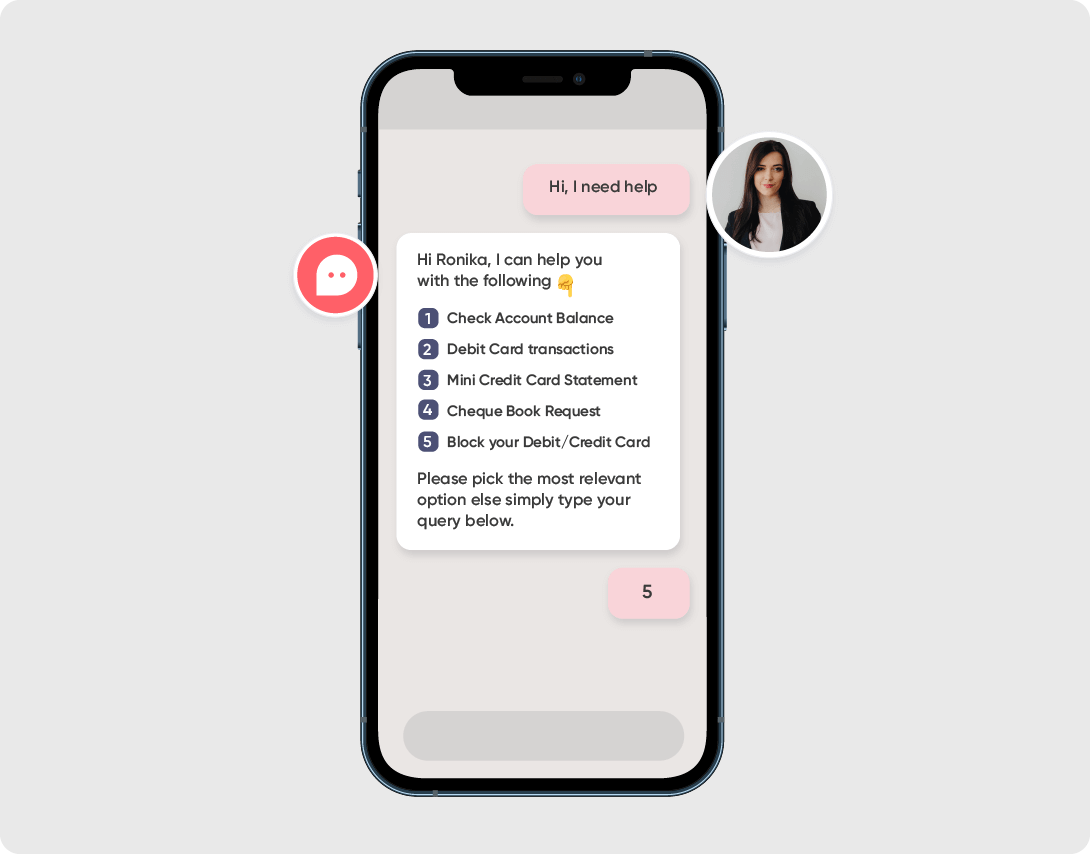

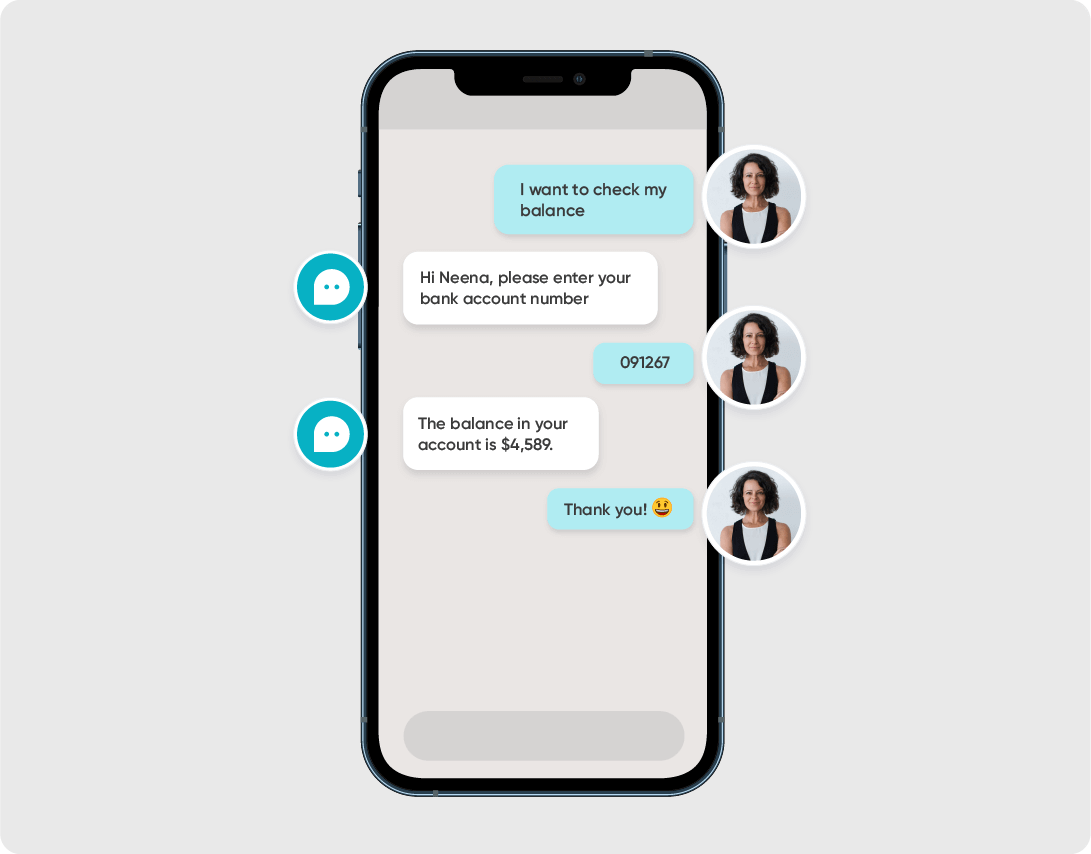

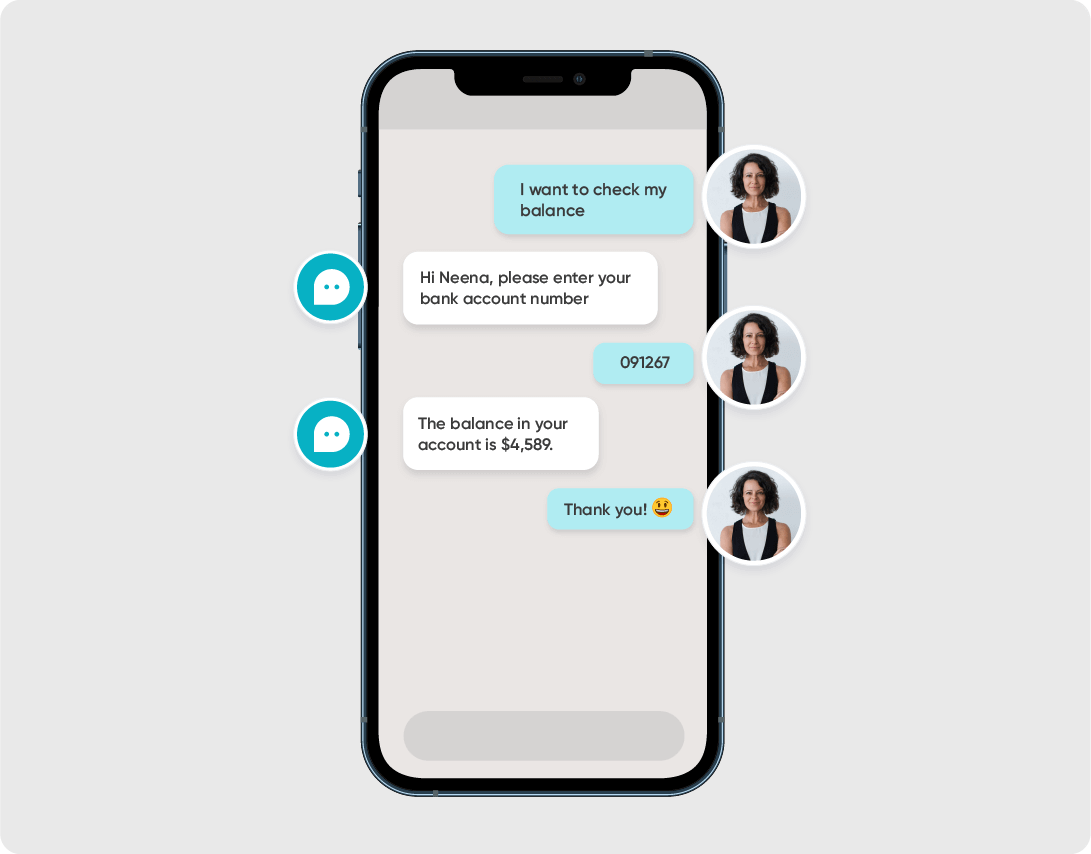

Automate 90% of query handling, campaign management, and transactional updates, providing personalised, human-like customer service that fosters trust and loyalty by creating enterprise-grade chatbots.

Enable chat banking and live chat support on WhatsApp, Facebook, in-app, voice and other channels with generative AI-powered agents for new offers, banking updates, quick answers, and a seamless banking experience, making interactions easy and efficient.

Respond promptly while maintaining a comprehensive view of customer interactions. Integrate seamlessly with your banking stack, creating a unified customer profile to provide a personalised support experience.

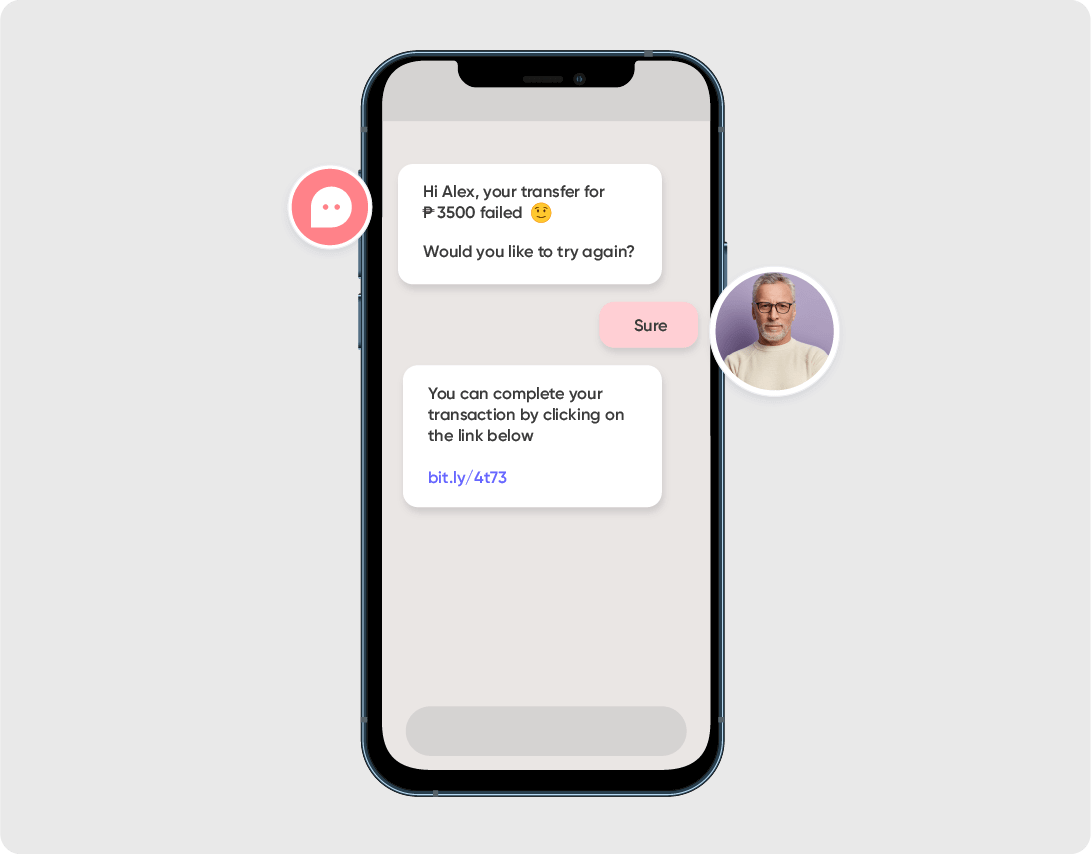

Connect with customers by proactively sharing personalised updates, offers, and information with customers. Upsell and cross-sell by anticipating needs and providing tailored solutions before they’re even requested.

Convert conversations into actionable insights. Our AI captures vital data, enabling you to access real-time metrics, including live chat analytics, predict trends, refine strategies, and ultimately improve customer experiences.

Fostering Empathetic Engagement with Conversational Banking Experience

Driving Support Efficiency for 500+ Brands Globally

How will your business benefit?

Increase Conversions

Guide customer decisions with accurate information and 90% better resolution to boost swift and informed choices for customers.

Save on Support Costs

Automate 80% of repetitive tasks, reducing operational expenses by 30% and improving CSAT by 4X through conversational banking.

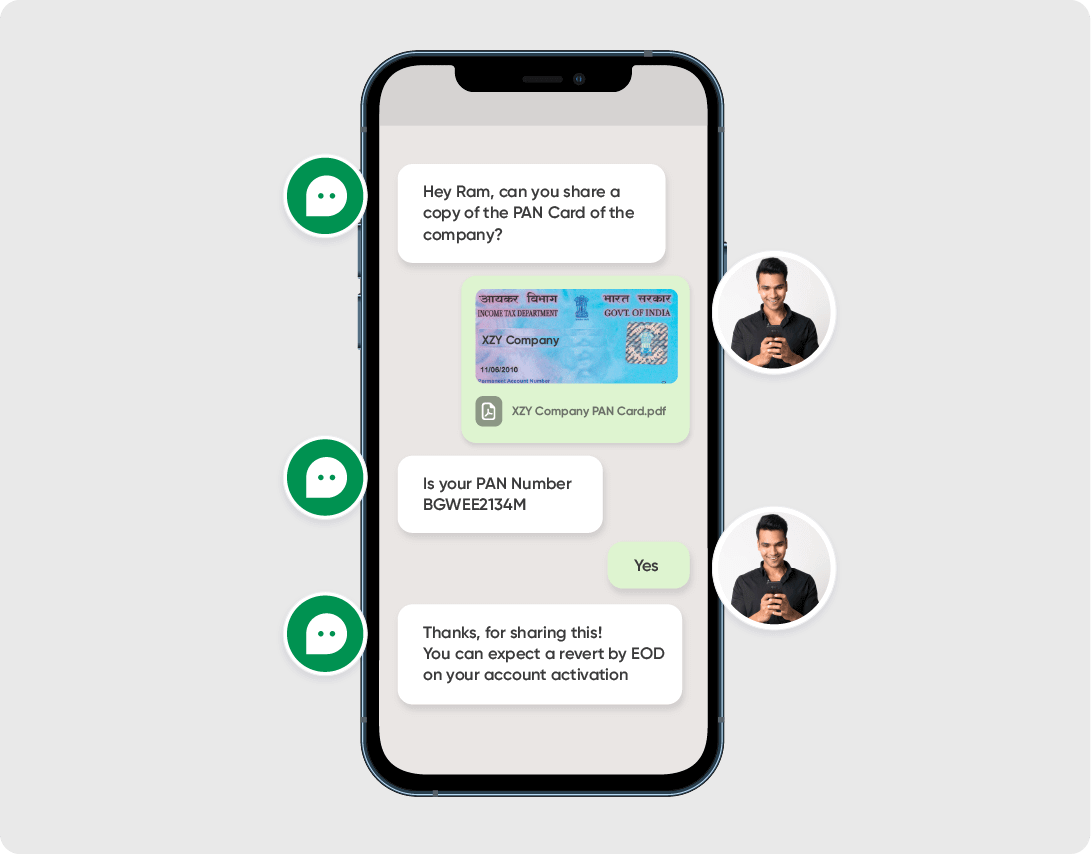

Lower Onboarding Time

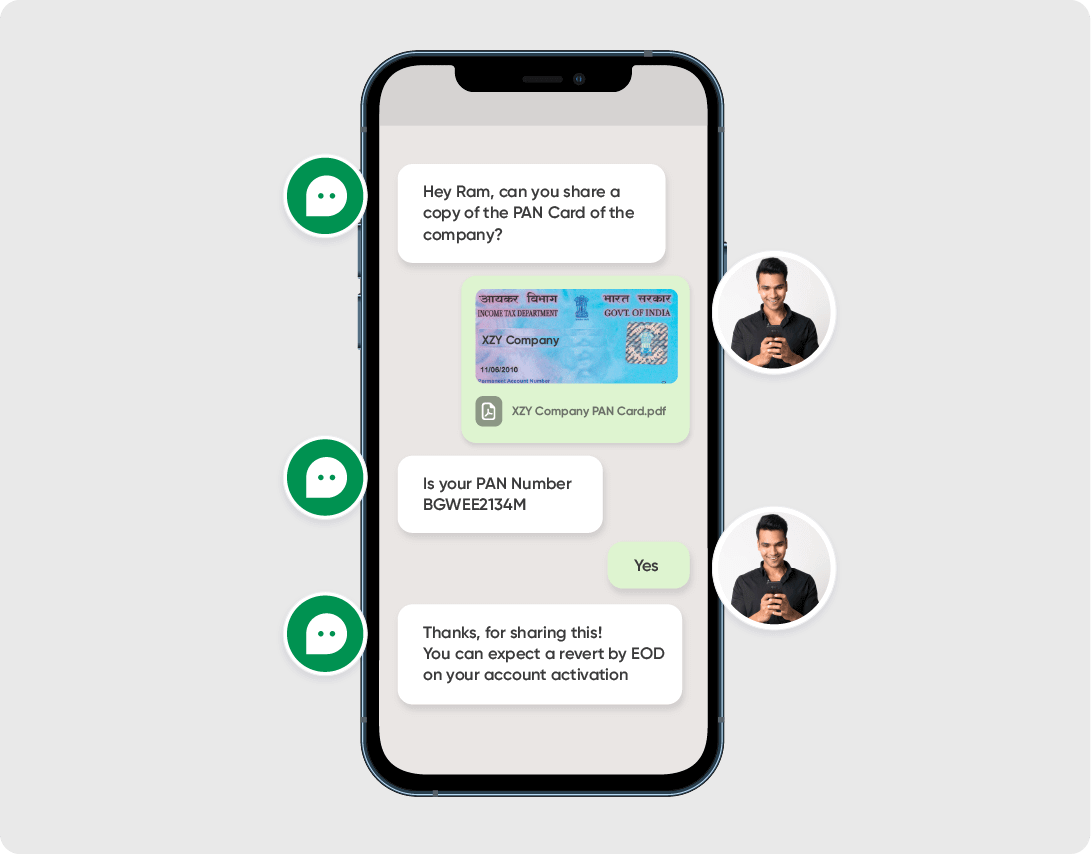

Use message, voice, and video for KYC, onboard, and activate customers, enhancing customer onboarding by more than 30%.

What is cooking in Verloop.io?

Gain insights on how we are helping brands improve their efficiency and productivity.

Frequently asked questions

Verloop.io is built with enterprise-grade security and compliance in mind. It supports encryption at rest and in transit, role-based access control, audit logging, and is now ISO/IEC 42001 certified, ensuring responsible and secure AI use for financial institutions. Alongside having GDPR and other security compliance certifications.

Yes. Verloop.io’s AI Agents can guide customers through KYC verification, loan eligibility checks, credit card applications, and routine account servicing—automating 80–90% of queries without human intervention.

Banks can deploy Verloop.io’s AI Agents across voice, chat (website or in-app), WhatsApp, and other social channels, offering consistent support while meeting compliance requirements.

Verloop.io’s Voice AI can be used to make outbound calls for payment reminders, fraud alerts, or lead qualification, ensuring timely and compliant communication without burdening human teams.

Yes. The platform supports dynamic workflows, backend integrations with CBS/CRM, and real-time data fetching, enabling it to handle multi-step processes like account unlocks, transaction dispute resolutions, and EMI calculations.

By deflecting high-volume, repetitive queries to AI chat and voice agents, banks using Verloop.io have seen significant reductions in call volume, agent load, and operational costs, without compromising customer experience.