How to Automate Quote Generation and Claim Automation with AI?

- June 23rd, 2025 / 5 Mins read

-

Aarti Nair

If you work in banking or insurance, you’ll know that generating quotes and processing claims can involve a tangle of paperwork, checks and approvals, which means added time and cost. Industry data shows that manual quote generation can take up to 45 minutes per application, while traditional claims workflows stretch out to a week or more.

Is that really the best use of your team’s expertise?

What if you could apply AI to your existing systems and cut quote turnaround by 70–80%, while trimming claims handling expenses by 30%?

By using natural language processing to extract customer details, machine-learning models to score risk, and robotic process automation for document checks, you can streamline these workflows end to end.

In this article, we’ll guide you through the key steps: identifying the right data sources, training models for pricing or adjudication, integrating with your policy or core banking platforms, and setting up monitoring to ensure accuracy. Along the way, ask yourself:

- Which parts of our quote process are most repetitive?

- Where do claims regularly get stuck?

The answers will help you see how an AI solution can help not only speed things up but also maintain regulatory compliance and customer trust. Let’s get started.

What is an Insurance Claim?

When a policyholder experiences a covered event—say, a car accident or property damage—they lodge a claim. That “First Notification of Loss” kicks off a multi-step journey:

- FNOL intake: Collecting incident details, policy and claimant information

- Validation: Verifying coverage, checking for fraud indicators, and confirming documentation

- Assessment: Evaluating repair estimates or medical bills, often with third-party service providers

- Adjudication: Determining payout amounts according to policy terms and deductibles

- Settlement: Issuing payment and closing the file

Traditionally, each of these phases requires human oversight from call-centre agents to adjusters and back-office teams. It’s no surprise that claim cycle times can stretch into days or weeks, and handling costs remain high.

What is the Claim Settlement Ratio?

Imagine you’re evaluating two insurers side by side. One settles nearly every claim within three months; the other leaves customers waiting and wondering. Claim settlement ratio (CSR) is the percentage of claims paid within a defined period. It is a powerful indicator of operational efficiency and customer satisfaction.

A Quick Snapshot of 2023–24 Performance

Across India’s market for general and health insurance, here’s how the four major groups stacked up for claims settled in under three months:

- Public-sector insurers averaged 86% of claims paid within 90 days.

- Private-sector insurers averaged 95%, leading the pack.

- Specialised insurers (agri and export credit) lagged at about 64%.

- Stand-alone health insurers settled 89% of claims on time.

So, if your CSR is below 90%, you’re trailing private players and may be losing customers to quicker-payout rivals.

Insurance Company | % Claims Paid in < 3 Months |

Public Sector Insurers | |

National Insurance Co. Ltd. | 91.18 % |

The New India Assurance Co. Ltd. | 92.70 % |

The Oriental Insurance Co. Ltd. | 65.08 % |

United India Insurance Co. Ltd. | 96.33 % |

Private Sector Insurers | |

Acko General Insurance Ltd. | 99.91 % |

Bajaj Allianz General Insurance Co. Ltd. | 95.99 % |

Cholamandalam MS General Insurance Co. Ltd. | 93.70 % |

Future Generali India Insurance Co. Ltd. | 90.93 % |

Go Digit General Insurance Ltd. | 96.71 % |

HDFC ERGO General Insurance Co. Ltd. | 99.16 % |

ICICI Lombard General Insurance Co. Ltd. | 97.16 % |

IFFCO Tokio General Insurance Co. Ltd. | 89.37 % |

Kotak Mahindra General Insurance Co. Ltd. | 96.76 % |

Liberty General Insurance Ltd. | 97.00 % |

Magma HDI General Insurance Co. Ltd. | 96.84 % |

Navi General Insurance Ltd. | 99.97 % |

Raheja QBE General Insurance Co. Ltd. | 94.53 % |

Reliance General Insurance Co. Ltd. | 99.57 % |

Royal Sundaram General Insurance Co. Ltd. | 97.26 % |

SBI General Insurance Co. Ltd. | 97.05 % |

Shriram General Insurance Co. Ltd. | 88.17 % |

Tata AIG General Insurance Co. Ltd. | 95.43 % |

Universal Sompo General Insurance Co. Ltd. | 98.11 % |

Zuno General Insurance Co. Ltd. | 83.12 % |

Specialised Insurers | |

Agriculture Insurance Co. of India Ltd. | 46.64 % |

ECGC Ltd. | 80.63 % |

General Insurers Total | 81.13 % |

Stand-alone Health Insurers | |

Aditya Birla Health Insurance Co. Ltd. | 92.97 % |

Care Health Insurance Ltd. | 92.77 % |

ManipalCigna Health Insurance Co. Ltd. | 88.59 % |

Niva Bupa Health Insurance Co. Ltd. | 92.02 % |

Reliance Health Insurance Ltd. | 40.00 % |

Star Health and Allied Insurance Co. Ltd. | 82.31 % |

Health Insurers Total | 88.55 % |

What does this tell you?

- Public vs Private: Private firms are closing claims faster.

- Health plans hold strong with nearly 9 in 10 claims paid on time.

- Specialised carriers have room to improve their processes dramatically.

By pinpointing where your CSR sits against these benchmarks, you can target the exact steps that are intake, validation, adjudication or settlement, where AI automation and streamlined workflows will have the biggest impact.

What is Insurance Quote Generation?

Think of an insurance quote as a personalised price tag for a customer’s specific needs. In traditional workflows, a client fills out a form—often online or on paper—with details like age, coverage amount and risk factors. Behind the scenes, an underwriter or agent checks each field, pulls historical data, runs calculations in a rating engine, and finally issues a premium.

That manual process can involve:

- Data entry: Typing customer details into multiple systems

- Rate look‐ups: Referring to tables or outdated spreadsheets to find applicable rates

- Adjustments: Applying discounts, loadings or special endorsements by hand

- Approval loops: Routing unusual or high-value applications for managerial sign-off

Each of those steps adds delay and introduces the risk of error. With AI-powered automation, you can extract key fields using optical character recognition (OCR), populate them into your rating engine in seconds, and apply business rules automatically.

Machine-learning models can even suggest optimal pricing based on portfolio performance, alerting underwriters when a quote falls outside normal bounds.

But ask yourself, “Which part of your quote process today eats up most of your team’s time, and how much could you save by automating it?”

Now that we know what quote generation and claim processes are in insurance, let’s understand how you can automate them. As quote generation is the first process, let’s begin with this.

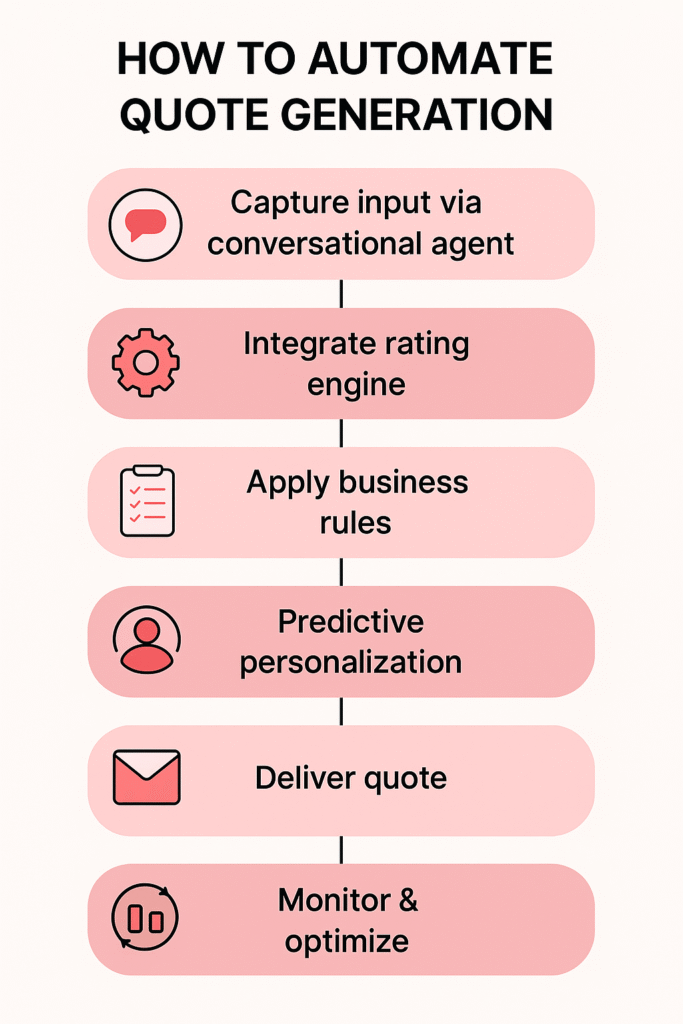

How to Automate Quote Generation with AI

Let’s say a potential customer visits your website, fills in a few details, and in under a minute receives a tailored insurance quote without any human underwriter involved. That’s the promise of AI-driven quote automation.

But how do you get there?

1. Capture Customer Inputs Seamlessly

Instead of asking clients to navigate complex PDF forms, embed a chat widget or smart form that asks only the essentials like age, coverage needs, and asset details. Behind the scenes, your AI uses natural language processing to interpret free-text answers and slot them into the right fields.

Have you ever abandoned a quote because the questions felt endless?

2. Plug into Your Rating Engine

Once the customer’s data is structured, an API call to your existing rating engine delivers a base premium in milliseconds. No more manual rate look-ups in spreadsheets or legacy tables.

The AI layer simply calls your pricing service with the inputs it just collected.

How much time do your underwriters spend searching for the correct rate today?

3. Apply Dynamic Business Rules

Every insurer has exceptions like loyalty discounts, high-risk loadings, and promotional codes. Configure these rules in a decision table or rules engine that your AI can reference automatically.

If a quote falls outside normal parameters, flag it for human review; otherwise, proceed.

Which special cases slow your quote process down the most?

4. Personalise with Predictive Models

Historical data can inform smarter pricing. Train a machine-learning model on your past policies to identify which profiles tend to renew or generate fewer claims.

Use those insights to offer personalised discounts or upsell coverages that customers actually value.

Could targeted recommendations boost your conversion rate?

5. Deliver the Quote Instantly

With all calculations and checks complete, the AI chatbot or email service presents the quote immediately, complete with breakdowns of premiums, deductibles, and optional add-ons. Customers get clarity at once, and your sales team sees the same quote on their dashboard.

How often do you lose prospects simply because they waited too long?

6. Monitor, Optimise, Repeat

Set up dashboards tracking quote-to-bind ratios, abandonment points, and exception volumes. If you spot customers dropping off at a particular question, tweak the flow. If your ML model drifts, retrain with fresh data.

Continuous improvement keeps your AI quote engine sharp.

When was the last time you reviewed which quotes convert—and which don’t?

By guiding customers through an intuitive interface, linking directly into your rating engine, and layering in business rules and predictive insights, you turn a tedious manual task into a friction-free, automated experience. That means faster responses for customers, lower processing costs for your team, and a smoother path from prospect to policy.

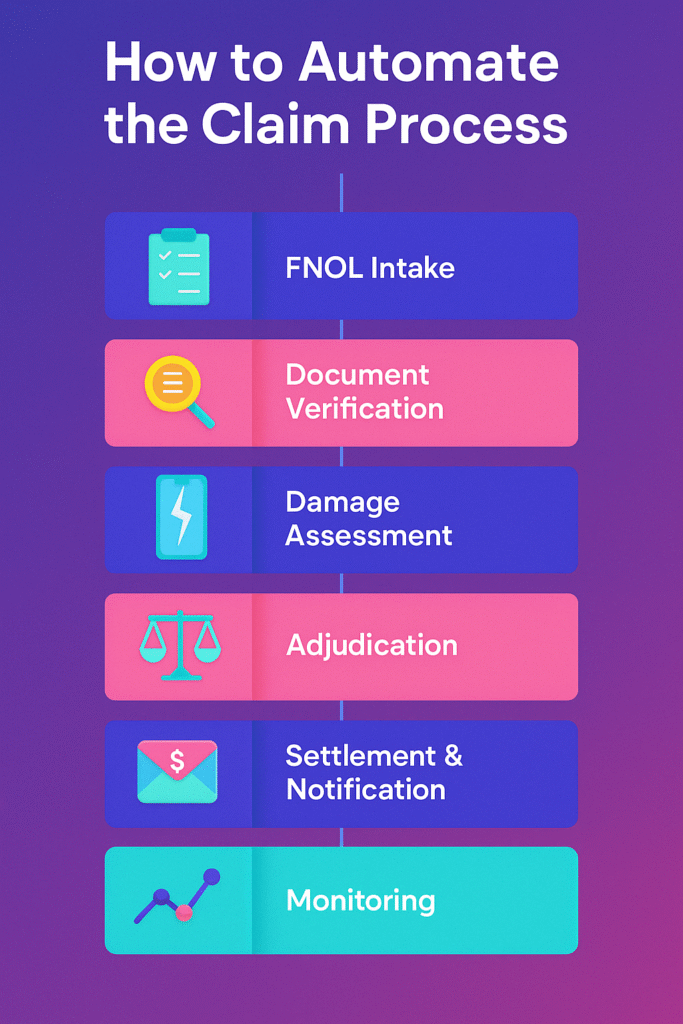

Automating the Insurance Claim Process with AI

Imagine a customer reporting a fender-bender at midnight and receiving a confirmation, a next-step timeline, and even a photo-based repair estimate—all without human intervention. Here’s how you can make that a reality:

1. Intelligent FNOL Intake

Instead of phone menus or static forms, deploy a conversational bot (voice or chat) to guide policyholders through the First Notice of Loss. It asks natural-language questions—date, location, damage description—and captures photos or documents on the spot. By the time a human intervenes, you have a complete, structured claim record.

“Could your team handle the initial report while you sleep?”

2. Instant Document Verification

Manual review of police reports and medical bills slows you down. Integrate an OCR engine that reads uploaded files, extracts key fields, and cross-checks against your policy database or third-party registries (vehicle, medical). Any discrepancies trigger a simple follow-up bot query.

“What if missing paperwork never reached an adjuster’s desk?”

3. Automated Damage Assessment

Train an image-analysis model on past claim photos to produce a first-pass cost estimate. The bot sends an instant repair or medical estimate, which then feeds directly into your claim system. For complex cases, route only flagged claims to human adjusters.

“Could half your inspections happen via smartphone photos?”

4. Rule-Based Adjudication & Straight-Through Processing

Feed your historical claim data into a machine-learning model that predicts risk levels. Low-risk, “green light” claims auto-approve; high-risk ones go to human review. A business-rules engine applies deductibles, co-payments, and policy limits automatically.

“How many claims could your team approve without opening a ticket?”

5. Seamless Settlement & Notifications

Integrate with your payment rails so approved claims trigger fund transfers or vendor payments immediately. Then, use the same bot to send SMS or email updates—no manual emails, no hold times.

“What if your customers saw ‘Paid’ in their inbox the moment you approved?”

6. Continuous Monitoring & Model Retraining

Set up dashboards tracking cycle times, auto-approved ratios, and exception rates. Periodically retrain your models on the latest data to catch new fraud patterns or policy changes—and adjust your OCR rules for evolving document formats.

“Are you confident your AI keeps pace with changing policies and fraud tactics?”

By weaving conversational AI, OCR, image analytics, predictive models, and automated payouts into a single workflow, you transform weeks-long claim cycles into near-instant processes—boosting customer satisfaction, slashing handling costs, and freeing your team to focus on complex cases.

Which Tools Should You Choose for Automating Quote Generation and Claim Process in Insurance?

When you piece together AI-driven quote and claims automation, each component plays a specific role. Here’s how you can apply proven tools in real scenarios—and the results you can expect.

Conversational AI Platforms

Deploy a Verloop.io AI agent on your website and phone line to collect FNOL details whenever a policyholder calls or chats. In one deployment, an insurer cut initial report times from ten minutes to under two and reduced call-centre load by 40%.

OCR & Document Processing

Feed scanned invoices, police reports or medical bills into AWS Textract. For a health insurer, this replaced manual entry, slashed verification time from one hour to five minutes per claim, and eliminated 90% of data-entry errors.

Image Analysis & Estimation

Use Clarifai’s pre-trained vision models to analyse customer-uploaded photos of vehicle damage. A motor insurer automated cost estimates, boosting straight-through processing by 60% and cutting average claim cycles from seven days to two.

Predictive Analytics & Risk Scoring

Train an H2O.ai model on three years of clean claims data to distinguish routine, low-risk cases from complex ones. One carrier automatically approved 35% of claims without human intervention, freeing adjusters to focus on high-value or suspicious files.

Robotic Process Automation

Set up UiPath bots to handle back-office tasks—updating policy records, triggering payments, sending emails. A large broker recovered 20 staff hours per week and reduced billing errors by 85%.

Integration & Orchestration

Connect all components—your Verloop.io bots, Textract OCR, Clarifai vision, H2O.ai predictions and UiPath RPA—via MuleSoft or a similar platform. One specialised insurer built this pipeline in six months, achieving true end-to-end automation and near-instant turnaround on both quotes and claims.

How Verloop.io Can Help

Are you ready to turn those tool recommendations into a working system? Verloop.io brings everything together under one roof. Our conversational AI handles both quote inquiries and FNOL intake, so customers never face a blank screen or a long wait. Behind the scenes, we feed that structured data into your rating engine or claims system via secure APIs—no more copy-paste or spreadsheet look-ups.

When a customer uploads documents, Verloop.io automatically routes them through OCR services and flags any missing information. Photos of damage pass through our image-analysis module to produce an instant cost estimate, which then triggers your business rules for discounts or approvals. Low-risk cases flow straight through, while complex ones alert your team for a quick human handoff.

Finally, once a quote is accepted or a claim approved, Verloop.io can invoke RPA bots to update policy records, initiate payments, and send status notifications by WhatsApp. The result is a seamless, end-to-end experience that slashes turnaround from days to minutes and lets your underwriters and adjusters focus on the exceptions, not the routine.

FAQs

1. What data do I need to start automating quotes and claims?

You’ll need historical policy and claims records (customer details, risk factors, past payouts), sample documents (invoices, reports, photos), and your existing rating or claims-processing rules. Quality and consistency in that data directly influence model accuracy.

2. How quickly can I expect to see ROI from AI automation?

Most organisations report measurable gains—30–50% faster turnaround and 20–40% cost savings—within 3–6 months of go-live. Your mileage will vary depending on claim volume, complexity, and the level of straight-through processing achieved.

3. Which systems does AI automation integrate with?

AI workflows plug into your core systems via APIs or RPA. Conversational bots connect to CRMs or policy engines; OCR and image-analysis services link to storage or document repositories; RPA handles legacy back-office tasks. Verloop.io and integration platforms like MuleSoft streamline these connections.

4. Will customers still need to talk to a human?

Yes—AI handles routine, low-risk queries end to end, but high-value or exceptional cases can trigger an immediate human handoff. This “human-in-the-loop” approach ensures quality control and maintains customer trust.

5. How is customer data secured in an automated pipeline?

All data in transit and at rest is encrypted, with role-based access controls enforced at each step. Leading platforms (Verloop.io, AWS, Google Cloud) comply with ISO 27001, GDPR and other regulations, and maintain audit logs for full traceability.

6. What’s the typical implementation timeline?

A basic quote-automation or FNOL-automation pilot can launch in 6–8 weeks. End-to-end automation—including OCR, image analysis, predictive scoring and RPA—usually takes 3–6 months, including data preparation, model training and user testing.